Venture investment in medical artificial intelligence amidst technological milestones and global shifts: 2013–2023

Introduction

The integration of artificial intelligence (AI) into various sectors has ushered in significant advancements, and the healthcare domain is no exception. The application of AI in healthcare, referred to here as medical AI (1), presents promising avenues for enhancing patient care, optimizing diagnostics, and improving overall healthcare delivery. Its transformative potential is increasingly acknowledged by the medical community (2).

Medical AI venture funding plays a pivotal role in fostering innovation in the field, acting as both an indicator of emerging trends and a catalyst for growth. In fact, scholars and policymakers alike believe that early-stage venture funding is the single most important element of the innovation pipeline in healthcare (3). Analyzing the flow of capital into young companies provides insights into the areas that garner investor interest, which often runs in parallel with sectors that are robust in scientific and technological advancement, thus highlighting sectors poised for expansion. With the burgeoning intersection of AI and healthcare (4), there arises a necessity to assess the dynamics of investment into medical AI over the past decade. Such an examination not only elucidates the landscape of funding, including strong investor sentiment toward investment in medical AI, spurred by seminal technologic advances, but also offers possible predictive insights for future trends.

A significant amount of literature has previously examined the impact and landscape of venture capital (VC) investments across specific countries including the US, Switzerland, and Canada (5-7), in fields including radiology, orthopedics, urology, oncology, ophthalmology, otolaryngology and dermatology (7-14). Across specialties, venture investment was found either to remain stagnant or decline in recent years. In fact, the decline in early-stage funding has led life science founders to seek alternative investment sources and garner public support, as alternative means to support innovation (15). These specialty-specific investigations do not capture the broader trend of investment in tools to optimize healthcare delivery and patient care, as many tools are not specialty-specific. Nor do any investigations examine the landscape of specifically AI-based medical companies, a sector that is otherwise seeing a breakneck pace of Food and Drug Administration approvals and growth (16,17). Notably, the majority of these investigations examined funding trends prior to 2022, the year ChatGPT (a web application leveraging large-language models to serve as intelligent search engine and virtual assistant) was launched, an important landmark for public sentiment toward AI.

This study is anchored in a detailed exploration of global funding activities spanning a decade, focusing on healthcare, AI, and medical AI. We leverage comprehensive data from the Pitchbook financial database, a database of private market data, focused on VC, private equity and merger and acquisition deals (https://pitchbook.com/). We aim to provide a granular view of the investment landscape, particularly in a time period that has seen major disruptive global events [coronavirus disease 2019 (COVID-19), interest rate cycles, the introduction of seminal AI technologies] that have impacted both investor sentiment and capital deployment. The specialty-agnostic approach of this study captures the broader medical AI innovation landscape, while our location-agnostic approach ensures that all sources of innovation are evaluated in the analysis. The scope of this analysis encompasses various deal stages, funding sources, and company ownership models, ensuring a holistic understanding of the financial ecosystem.

Methods

We examined venture investments in the sectors of healthcare, AI, and medical AI (the overlap of healthcare and AI companies) spanning the 10-year period from October 7, 2013 to October 6, 2023. To catalog the entirety of these deals, results were obtained from Pitchbook’s comprehensive database. The Pitchbook database was chosen as it is widely recognized as the most comprehensive database of global VC, private equity, and merger and acquisition transactions (18). Although it is possible that Pitchbook may miss deals in emerging markets with less robust institutional reporting, it is broadly trusted in the private capital markets industry and has been utilized in a number of previous academic analyses, some of which have been referenced in this study. It is the most comprehensive resource available to perform such a study.

All searches including the following criteria: deals were limited to completed transactions, but could comprise all stages, round numbers, and series; these are financial terms used to describe the different stages of growth a startup may be in and their associated funding characterization. There was no restriction on the year a company was founded. There was no minimum or maximum deal monetary value criteria imposed, but only full, completed transactions were included in the analysis. Our search was location-agnostic, allowing us to analyze deals across the world. All ownership models, including publicly and privately-owned companies, those in initial public offering (IPO) registration, and those that had been acquired or merged, or were a subsidiary of an acquired/merged entity were included in this analysis. In this way, we did analyze “all-comers” for deals completed without unnecessarily restricting our analysis to certain types of company ownership models. Custom search criteria using Boolean operations for each of the aforementioned sectors are as follows:

- Healthcare: (Healthcare: Industry == “Healthcare”) OR (Healthcare: Emerging Spaces == “Healthcare”) OR (Healthcare: Verticals == “HealthTech”);

- AI: (Vertical == “Artificial Intelligence and Machine Learning”);

- Medical AI: ((Industry == “Healthcare”) OR (Emerging Spaces == “Healthcare”) OR (Verticals == “HealthTech”)) AND (Vertical == “Artificial Intelligence and Machine Learning”).

After searches were completed, databases of results were reviewed to ensure accuracy of the search terms, by two authors, N.K.J., and V.R. Data analysis was performed using operations available in Microsoft Excel (Microsoft Corporation, Redmond, WA, USA). Descriptive statistics were extracted for this analysis. Student’s t-tests were performed to assess for differences in year-over-year (YoY) financial metrics between industries. For statistics related to deal terms and/or deal stage, only those deals with reported statistics were included.

Results

Deal flow

Deal flow represents the total number of deals made over a given time period.

From October 2013 to 2023, 39,927 healthcare, 25,250 AI, and 4,070 medical AI companies received funding (Table 1). Medical AI was dominated by devices (25.80%), followed by insurance (14.40%) and pharmaceuticals/biotechnology (9.50%) (Figure 1). The healthcare sector had 120,555 deals, AI had 79,941, and medical AI had 14,070. Healthcare’s seed or early-stage investments were 30.9%, AI’s 41.1%, and medical AI’s 37.6%. Later-stage VC comprised 17.5% of healthcare, 14.5% of AI, and 14.1% of medical AI deals. Although geographical distribution was not markedly different between industry sectors, there were large differences present in deal flow across geographic regions (Table 1).

Table 1

| Metric | Healthcare | AI | Medical AI |

|---|---|---|---|

| Total companies, n | 39,927 | 25,250 | 4,070 |

| Total deals, n or n (%) | 120,555 | 79,941 | 14,070 |

| Africa | 907 (0.8) | 484 (0.6) | 85 (0.6) |

| Americas | 66,265 (55.0) | 35,185 (44.0) | 6,904 (49.1) |

| Asia | 21,044 (17.5) | 18,431 (23.1) | 2,737 (19.5) |

| Europe | 27,622 (22.9) | 20,993 (26.3) | 3,516 (25.0) |

| Middle East | 2,683 (2.2) | 3,417 (4.3) | 591 (4.2) |

| Oceania | 1,694 (1.4) | 1,146 (1.4) | 161 (1.1) |

| Unknown | 340 (0.3) | 285 (0.4) | 76 (0.5) |

| Total capital (million $) | 639,370 | 484,730 | 70,753 |

| Seed, n (%) | 15,316 (12.7) | 15,617 (19.5) | 2,540 (18.1) |

| Early-stage VC, n (%) | 21,923 (18.2) | 17,211 (21.5) | 2,750 (19.5) |

| Later-stage VC, n (%) | 21,140 (17.5) | 11,631 (14.5) | 1,981 (14.1) |

| Corporate, n (%) | 3 (0) | 3 (0) | 0 (0) |

| Angel, n (%) | 4,968 (4.1) | 2,990 (3.7) | 478 (3.4) |

AI, artificial intelligence; VC, venture capital.

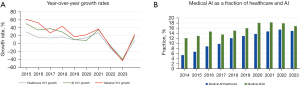

YoY growth in deal volume was 8.2% for healthcare, 17.7% for AI, and 23.2% for medical AI. These differences were statistically significant when comparing AI to healthcare (P=0.02) and medical AI to healthcare (P=0.01), however not significant when comparing AI to medical AI. All sectors saw a deal volume increase in 2021 but declined in 2022 and 2023 (Figure 2A). Medical AI constituted an increasing percentage of AI deals since 2014 (12%), peaking at 18.2% in 2021, and ending at 17.3% in 2023. Medical AI captured an increasing proportion of healthcare deals as well, comprising 5.3% of healthcare deals in 2014, and increasing to 14.8% in 2023 (Figure 2B).

Capital flow

Capital flow represents the total dollar amount of capital that is being exchanged in deals over a given time period.

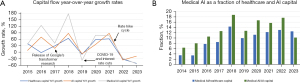

Over the 10-year period, healthcare raised over $639 billion, while AI secured $485 billion. Medical AI contributed 14.6% to the AI sector and 11.1% to the healthcare sector, totaling nearly $71 billion. The AI sector’s YoY growth rate (27.4%) exceeded healthcare’s (17.7%), but medical AI’s growth (46.5%) surpassed both (P=0.01) compared to healthcare and P=0.03 compared to AI). After a dip in 2019, 2020 and 2021 saw rebounds in capital investments (Figure 3A). In 2014, medical AI constituted 6.3% of AI and 3.5% of healthcare capital. By 2018, these figures jumped to 18.7% for AI and 14.3% for healthcare. However, by 2023, medical AI’s share of AI funding dropped to 10.2%, but remained consistent in the healthcare sector at 12.5% (Figure 3B).

Median deal size increased steadily for all sectors, with an increase of 90% from 2014 to 2023 in the healthcare sector, 106.8% in the AI sector, and 114.7% in medical AI. Despite a large rebound in total deal capital in 2020 and 2021, median funding round size was not impacted significantly in the same time period, and in fact, remained steady through the fluctuations in total deal capital (Figure 3).

Valuations

Valuation is a term representing the estimated worth or “value” of a company, often determined by the size of the most recent deal in the private capital markets. For example, an investment of $1 million for a 10% stake in the company would equate to a $10 million valuation.

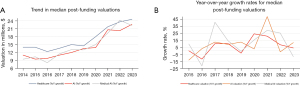

Median post-funding valuations followed similar trends. Although valuations in the healthcare sector rose steadily over the 10-year period, at a rate of 7%, AI outperformed healthcare with a valuation growth rate of 9.4%. Medical AI outperformed both sectors with a growth rate of 11.5%, though these differences did not reach statistical significance. Valuations for all sectors saw a significant rise after 2020, which appeared to increase or hold steady through the following years (Figure 4).

Discussion

Herein, we present a novel investigation of 10 years of venture investment in medical AI. This study probes deal flow, capital flows, and valuations, providing insights that have not previously been documented. The findings of our study are applicable to nearly every field tangential to healthcare, as this evolving technology may herald groundbreaking innovations to advance healthcare quality and delivery. This timeframe captures seminal events, such as Google’s release of their research into transformer models (the technology that serves as the backbone for large language models like ChatGPT), and COVID-19 stimulus (the government-issued stimulus designed to offset the impacts of COVID-19 on markets and the economy) and interest rate cycles (rise and fall of interest rates over time).

Although geographic disparities continue to persist, especially highlighting a lack of funding in African innovation in favor of strong investor preference for Europe and the Americas (Table 1), the overall funding landscape of medical AI continues to hold promise. Despite the fact that significant global economic opportunities which arose in recent years appear to have passed, deal sizes and industry growth appear to remain strong, with medical AI demonstrating significantly higher YoY growth in capital and deal flow as compared to the healthcare and AI sectors. As young industries (19), AI and medical AI sectors are dominated by early-stage funding, possibly owing to the recent explosion of technological advances in these spaces, which may also explain the rapid growth in these spaces. And valuations continue to grow despite the decrease in deal flow, reflecting investor sentiment that the economic value of these companies likely exists beyond the circumstances of specific points in time (20).

The years 2017 witnessed the release of Google’s manuscript detailing the transformer model (21). This manuscript detailed the technological breakthrough on which the majority of large language models, like ChatGPT, are built. This marked a true paradigm shift in AI, unlocking the potential for myriad applications across all industries, particularly healthcare and medicine. In 2018, deal flow for medical AI increased significantly relative to the healthcare sector as a whole. Additionally, in 2018, medical AI saw a large spike in total capital raised and captured a significantly higher portion of both the AI sector and healthcare sector than in past years.

The year 2020 ushered in an era of mega-valuations for all sectors. This was likely due to large capital influx into the VC markets secondary to low interest rates during this time period (22). In addition, this time period saw a societal shift to digital tools to solve workflow, supply chain, and logistical challenges, in addition to significant healthcare challenges that became evident due to the COVID pandemic (23). It is likely that the combination of these factors led to the rapid pace of deals in the selected industries, as it witnessed sharp rises in deal volume, and significant increases in deal size, leading to massive growth in total capital investment during this time period.

October 2022 saw the public release of ChatGPT, a humanoid chat interface built on a large language model (24). Funding for AI companies, including medical AI, rose significantly in 2023, disproportionately compared to the healthcare sector (total deal capital for AI in 2023 surpassed that of the Healthcare sector for the first time in the 10-year period, Figure 3). This possibly correlated to a marked interest and use cases for general AI and natural language processing/large language model technology. It is likely that the increased allocations in funding with rising valuations will continue to draw both entrepreneurs and investors to the field of medical AI, which promises to lead to an increase in available tools in patient care and diagnostics. The increased capital flow will also allow companies to attract and hire top talent to optimize healthcare delivery.

Many have proposed that the AI funding boom is a “bubble” (25), meaning companies are overvalued, and likely will be pursuing “down rounds” or running out of capital in the near future. Our analysis reveals that, post-pandemic in 2022–2023, YoY capital flow decreased across all sectors, but median deal size and valuations either rose or remained steady across all sectors. This pattern suggests investors might be more selective, yet still keen on investing in promising ventures without concerns over present valuations. Overall, these trends are consistent with the earlier stages of a bubble in AI and medical AI. Factors that point towards this perspective include: the large amount of “dry powder” that exists in VC (money that VC firms retain but have not been invested into companies, which is at an all-time high) (26), a period of low interest rates which led to a more favorable investment environment (and the possibility of another round of cuts approaching), and strong fundamentals in AI with models and the technologies evolving at breakneck pace. While bubbles traditionally carry a negative connotation, it is natural that they develop in emerging technologies as investors, entrepreneurs, scientists, and investors propagate interest in the sector. As with the dot-com bubble, there will come a point where marked speculation and poor due diligence even within the VC world signal exuberant froth, but that does not seem to be the case at present with deal and capital flow decreasing. We predict that the true bubble is yet to come, and there still exists significant opportunity for entrepreneurial scientists and innovators to enter this space. Furthermore, from a historical context, the current AI bubble is much smaller than other bubbles we have witnessed in financial markets (27).

The amount of “dry capital” on the sidelines is worth exploring as well. A multitude of factors play a role in deploying VC funds. Typically, these funds have been raised years in advance. In the years preceding 2022, which saw a rapid increase in interest rates, investor appetite was large and it was easier for VC firms to raise capital from liquidity providers (i.e., corporations, entities, wealthy individuals who give money to VC firms to invest) and deploy capital from pre-existing funds. However, for the last 2 years, in the face of soaring inflation, high interest rates, and already high valuations lingering from the COVID-19 period of investor exuberance, the landscape is at present far from ideal for venture capitalists to engage in new deals, likely contributing to the record amount of sidelined capital, again indicating that the current period is not yet a “bubble” though may evolve into one in coming years. VC firms are prioritizing investments that are most likely to net outsized returns, which may explain why valuations are continuing to rise for a subset of investments whereas overall deal flow and capital flow decreases. Venture firms may be prioritizing returning capital to liquidity providers (i.e., prioritizing selling investments and keeping profits to pay back the entities who invested their money with the venture firms) over deploying new capital in a less than favorable environment. It is possible these profits are being kept for the venture firm partners as well. The authors predict that if interest rates were to decrease, VC funds would begin to aggressively deploy sidelined capital, and it would be an opportune time for innovators to raise money.

Limitations of this study included the lack of robust data for all deals in the Pitchbook database, owing to the private nature of many companies, and lack of imperative to disclose deal terms. Although it is likely that companies of a medical nature, or those that use AI might include these terms in their Pitchbook company descriptions, it is possible that despite exhaustive search methodology, companies without these keywords were missed. Although Pitchbook is a comprehensive database, as a leader in this industry, the data collected by Pitchbook may serve to further propagate investment trends. We note that neutrality is difficult to achieve, and such databases do not merely mirror the economic landscape but actively shape it by prioritizing certain types of data collection and interpretation—for example, data collection is focused largely on deal sizes, revenue, and industry categorizations, whereas social or environmental impact and diversity in leadership are less well-measured. Seminal works in economic life and data science such as Stefan Leins’ ‘Stories of Capitalism’ and Jens Beckert’s espouse that VC investments are often driven not just by empirical data but by the narratives that surround potential investments. For example, the enthusiastic funding of AI-driven diagnostic tools over less ‘glamorous’ but crucial areas like patient data management systems can be seen as a result of compelling narratives about the transformative potential of AI in diagnostics overshadowing equally important aspects of healthcare technology (28,29). As emphasized by Catherine D’Ignazio and Lauren Klein in their work ‘Data Feminism’, we recognize that certain data collection and visualization techniques may inadvertently marginalize certain groups or perspectives (30). For example, although geographic investment trends may be gleaned from Pitchbook, the social status of founders or investors is not easily accessible, nor are the types of healthcare challenges addressed. Collecting this data might reveal the lack of funding for startups doing social good with less revenue potential, or the lack of funding reaching minority founders.

While it is difficult to predict the future, it appears that healthcare, AI, and especially medical AI remain healthy, despite a slowed VC fundraising landscape in 2023. Despite cautious investor sentiment, the amount of “dry powder” (sidelined liquidity not deployed in the private markets) in the VC landscape is at an all-time high (26), and our analysis indicates that when it comes to medical AI, investors still have significant interest in valuable opportunities. Until data seems to prove otherwise, it seems that the medical AI sector’s trend (that some may call a bubble) may continue to grow.

Acknowledgments

Funding: None.

Footnote

Data Sharing Statement: Available at https://jmai.amegroups.com/article/view/10.21037/jmai-24-31/dss

Peer Review File: Available at https://jmai.amegroups.com/article/view/10.21037/jmai-24-31/prf

Conflicts of Interest: All authors have completed the ICMJE uniform disclosure form (available at https://jmai.amegroups.com/article/view/10.21037/jmai-24-31/coif). The authors have no conflicts of interest to declare.

Ethical Statement: The authors are accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved.

Open Access Statement: This is an Open Access article distributed in accordance with the Creative Commons Attribution-NonCommercial-NoDerivs 4.0 International License (CC BY-NC-ND 4.0), which permits the non-commercial replication and distribution of the article with the strict proviso that no changes or edits are made and the original work is properly cited (including links to both the formal publication through the relevant DOI and the license). See: https://creativecommons.org/licenses/by-nc-nd/4.0/.

References

- Rajpurkar P, Chen E, Banerjee O, et al. AI in health and medicine. Nat Med 2022;28:31-8. [Crossref] [PubMed]

- Cadario R, Longoni C, Morewedge CK. Understanding, explaining, and utilizing medical artificial intelligence. Nat Hum Behav 2021;5:1636-42. [Crossref] [PubMed]

- Karpa W, Grginović A. Long-term perspective on venture capital investments in early stage life-science projects related to health care. Economic Research-Ekonomska Istraživanja 2020;33:2526-40. [Crossref]

- Spatharou A, Hieronimus S, Jenkins J. Transforming healthcare with AI: The impact on the workforce and organizations. McKinsey & Company. Published March 10, 2020. Accessed October 14, 2023. Available online: https://www.mckinsey.com/industries/healthcare/our-insights/transforming-healthcare-with-ai​%60%60oaicite:%7B%22number%22:1,%22metadata%22:%7B%22type%22:%22webpage%22,%22title%22:%22Transforming

- Lehoux P, Miller FA, Daudelin G. How does venture capital operate in medical innovation? BMJ Innov 2016;2:111-7. [Crossref] [PubMed]

- Hosang M. Venture Capital Investment in the Life Sciences in Switzerland. Chimia (Aarau) 2014;68:847-9. [Crossref] [PubMed]

- Lexa FJ, Van Moore A. Venture Capital in US Medicine: A Briefing for Radiologists. J Am Coll Radiol 2024;21:489-92. [Crossref] [PubMed]

- Briggs LG, Uppal N, Langbein B, et al. Venture capital investment in urology, 2011 to mid-2021. Can J Urol 2023;30:11659-67. [PubMed]

- Cwalina TB, Jella TK, Acuña AJ, et al. Venture Capital Investment in Orthopaedics: Has the Landscape Changed over the Past Two Decades (2000-2019)? Surg Innov 2022;29:103-10. [Crossref] [PubMed]

- Huang KB, Nambudiri VE. How Is Money Changing Medicine?-Venture Capital Investment in Oncology. JAMA Oncol 2020;6:325-6. [Crossref] [PubMed]

- Gupta S, Uppal N, Chang EK, et al. Trends in Venture Capital Investments in Ophthalmology Companies (2011-2021). Ophthalmology 2022;129:353-4. [Crossref] [PubMed]

- Venkatesh K, Nambudiri VE. Characterization of venture capital investments in dermatology: A cross-sectional analysis, 2011 to 2021. J Am Acad Dermatol 2023;88:665-7. [Crossref] [PubMed]

- Rathi VK, Murr AH, Feng AL, et al. Analysis of Venture Capital Investment in Therapeutic Otolaryngologic Devices, 2008-2017. JAMA Otolaryngol Head Neck Surg 2019;145:387-9. [Crossref] [PubMed]

- Agarwal A, Orlow SJ. Skin in the Game: An Analysis of Venture Capital Investment in Dermatology from 2002 to 2021. J Invest Dermatol 2023;143:533-537.e1. [Crossref] [PubMed]

- Fleming JJ. The decline of venture capital investment in early-stage life sciences poses a challenge to continued innovation. Health Aff (Millwood) 2015;34:271-6. [Crossref] [PubMed]

- Suren A, Dietrich M, Osmers M, et al. Transvaginal sonography in patients with pathological cervical exfoliative cytology or histologically verified cervical carcinoma. Int J Gynaecol Obstet 1994;47:141-5. [Crossref] [PubMed]

- Palmer CR Katie. After a lull, the pace of FDA authorization of AI-enabled medical devices is rising. STAT. Available online: https://www.statnews.com/2023/10/20/fda-ai-enabled-devices-authorization/?mc_cid=b4a72f0210&mc_eid=a350c8d202

- Kaplan SN, Lerner J. Venture capital data: opportunities and challenges. Harvard Business School. 2016. [Accessed April 4, 2024]. Available online: https://www.hbs.edu/faculty/Publication%20Files/17-012_10de1f93-30e4-4a98-858c-4137556ec037.pdf

- Kaul V, Enslin S, Gross SA. History of artificial intelligence in medicine. Gastrointest Endosc 2020;92:807-12. [Crossref] [PubMed]

- Schwartz AJ. Money Supply. Econlib. [Accessed October 14, 2023]. Available online: https://www.econlib.org/library/Enc/MoneySupply.html

- Vaswani A, Shazeer N, Parmar N, et al. Attention is All You Need. 31st Conference on Neural Information Processing Systems (NIPS 2017), Long Beach, CA, USA. Available online: https://proceedings.neurips.cc/paper_files/paper/2017/file/3f5ee243547dee91fbd053c1c4a845aa-Paper.pdf

- Gofran RZ, Gregoriou A, Haar L. Impact of Coronavirus on liquidity in financial markets. Journal of International Financial Markets, Institutions and Money 2022;78:101561. [Crossref]

- McKinsey & Company. How COVID-19 has pushed companies over the technology tipping point-and transformed business forever. Published October 5, 2022. [Accessed October 14, 2023]. Available online: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

- Gordon C. Will 2023 Be The Year That OpenAI’s ChatGPT Breaks Free? Forbes. December 20, 2022. [Accessed October 14, 2023]. Available online: https://www.forbes.com/sites/cindygordon/2022/12/29/will-2023-be-the-year-that-openais-chatgpt-breaks-free/?sh=77bf72063b1c​

- Daniel W. Artificial Intelligence Bubble and Its Impact on the Stock Market: Insights from Morgan Stanley. Fortune. August 10, 2023. [Accessed October 14, 2023]. Available online: https://fortune.com/2023/08/10/artificial-intelligence-bubble-stock-market-investor-advice-morgan-stanley/

- Mathews J. The 2022 VC crash, in 4 charts. Fortune. October 10, 2023. [Accessed October 14, 2023]. Available at: https://fortune.com/2023/10/10/vc-fund-crash-2022-charts/

- Mozée C. BofA says AI is in a “baby bubble” that echoes the dot-com era, and one move could easily blow up the investment frenzy ignited by ChatGPT. Markets Insider. Available online: https://markets.businessinsider.com/news/stocks/ai-stocks-chatgptartificial-intelligence-baby-bubbledot-com-bust-2023-5

- Leins S. Stories of Capitalism: Inside the Role of Financial Analysts. University of Chicago Press; 2018.

- Uncertain Futures: Imaginaries, Narratives, and Calculation in the Economy. Oxford University Press; 2018.

- D'Ignazio C, Klein LF. Data Feminism. MIT Press; 2020.

Cite this article as: Jairath NK, Ramachandran V, Orlow SJ. Venture investment in medical artificial intelligence amidst technological milestones and global shifts: 2013–2023. J Med Artif Intell 2024;7:27.